The Hidden Tax Strategy That Could Save You Thousands Every Year

Most investors focus on what to buy—but the smartest ones also focus on where to buy it.

If you've been investing for any length of time, you've probably heard the golden rule: diversify your portfolio. Spread your money across stocks, bonds, and cash to protect yourself when markets get rocky. It's Investment 101, and for good reason—asset allocation is the foundation of any solid investment strategy.

But here's what most people don't know: where you hold your investments can be just as important as what you hold. This lesser-known strategy is called asset location, and it could be costing you thousands of dollars in unnecessary taxes.

What Exactly Is Asset Location?

Think of asset location as playing chess with the tax code. It's the art of strategically placing your investments in the right type of account—taxable, tax-deferred, or tax-free—to minimize what you owe Uncle Sam.

The goal is simple: match each investment with the account that gives it the best tax treatment. Do this right, and you'll keep more of your returns working for you instead of going to taxes.

Understanding the Tax Game: Not All Investment Income Is Created Equal

Before we dive into the strategy, you need to understand how different types of investment income get taxed—because the tax code definitely plays favorites.

Interest Income: Taxed Like Your Paycheck When you earn interest from bonds, CDs, or high-yield savings accounts, the IRS treats it just like your salary. That means it's taxed at ordinary income rates, which can range from 10% to 37% depending on your tax bracket. For high earners, that's a hefty chunk.

Capital Gains: The Tax Code's Favorite Child When you sell an investment for more than you paid, that profit is a capital gain. But here's where it gets interesting—the tax rate depends on how long you held the investment:

- Short-term capital gains (held less than one year): Taxed as ordinary income, just like interest

- Long-term capital gains (held more than one year): Get special preferential rates of 0%, 15%, or 20% depending on your income level

This difference is huge. If you're in the 32% tax bracket, your bond interest gets taxed at 32%, but your long-term stock gains might only be taxed at 15%. That's why asset location matters so much.

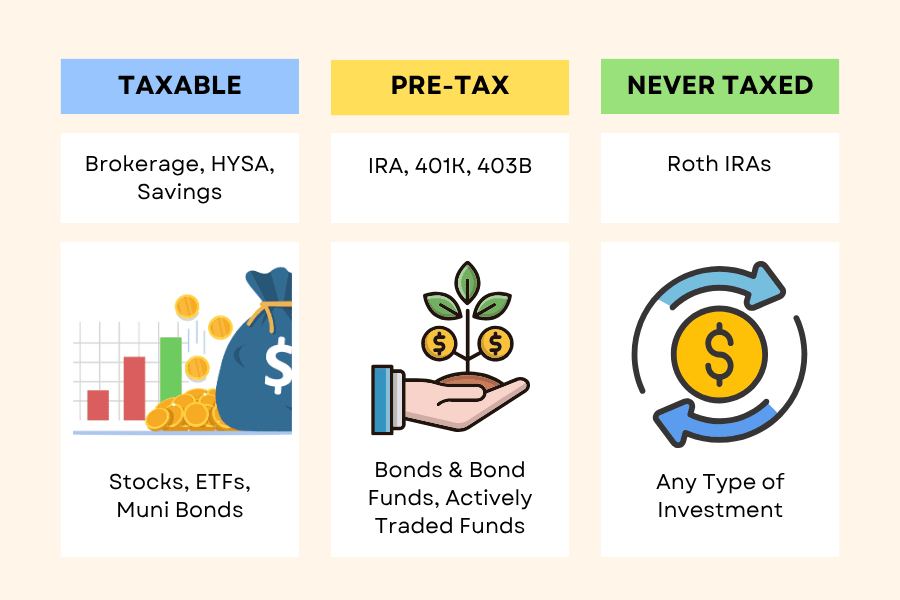

Your Account Toolkit: Three Types, Three Tax Treatments

Before we dive into strategy, let's understand your options:

Taxable Accounts (Your Standard Brokerage Account)

- No contribution limits—invest as much as you want

- Pay taxes annually on interest, dividends, and capital gains

- Most flexible for withdrawals

Tax-Deferred Accounts (Traditional IRAs, 401(k)s, 403(b)s)

- Get a tax deduction when you contribute

- Investments grow tax-free until withdrawal

- Pay ordinary income tax rates when you withdraw in retirement

Tax-Free Accounts (Roth IRAs, Roth 401(k)s)

- No tax deduction when you contribute (you pay with after-tax dollars)

- Investments grow completely tax-free

- Withdraw everything tax-free in retirement

The Asset Location Game Plan: Tax-Inefficient vs. Tax-Efficient Investments

Here's where the strategy gets interesting. Some investments are tax-inefficient—they generate lots of taxable income that gets hit with higher rates. Others are more tax-efficient, generating returns that qualify for better tax treatment. Your job is to put each type where it makes the most sense.

Shelter Your Tax-Inefficient Investments in Pre-Tax Accounts

These investments should go in your IRAs and 401(k)s:

Bonds and Bond Funds Why? Bond interest gets taxed at your ordinary income rate, which can be as high as 37% for high earners. Tuck these away in a traditional IRA, and that interest can compound without the annual tax bite.

Actively Managed Funds These funds trade frequently, creating taxable events even when you don't sell. Shelter them in tax-advantaged accounts to avoid this "tax drag."

Keep Your Tax-Efficient Investments in Taxable Accounts

These can handle the tax exposure:

Index Funds and ETFs These generate most of their returns through long-term capital appreciation, which gets preferential tax treatment. Plus, they rarely distribute capital gains, so you control when you realize taxes by choosing when to sell.

Individual Stocks (for long-term holding) Same principle—you're mainly looking at capital gains treatment, and you control the timing.

Municipal Bonds These are the exception to the bond rule. Since municipal bond interest is usually tax-free at the federal level (and sometimes state level too), they make sense in taxable accounts.

The Roth Account Superpower

Here's where asset location gets really exciting. Roth accounts are tax-free forever, making them incredibly versatile and powerful.

The beauty of Roth accounts is that any type of investment can go in there—stocks, bonds, REITs, mutual funds, you name it. Once it's in a Roth, all future growth and income is completely tax-free forever.

This makes Roth accounts perfect for two scenarios:

Your highest-growth potential investments: Got a stock you think could be the next Amazon? A small-cap fund that might explode over the next 20 years? Put it in your Roth IRA. Every dollar of growth will be completely tax-free when you withdraw it in retirement.

High-income generating assets: Remember those tax-inefficient bonds we talked about? While they make sense in traditional IRAs to defer taxes, they can be even better in a Roth. That steady stream of interest payments will compound tax-free instead of getting hit with ordinary income rates year after year.

Think about it: Would you rather pay taxes on a $10,000 bond investment generating 5% interest annually, or pay taxes on the original $10,000 and keep all that interest income tax-free forever? That's the Roth advantage.

The Bottom Line: Small Moves, Big Impact

Asset location won't make headlines like picking the next hot stock, but it's one of those quiet strategies that can add serious value over time. By thoughtfully placing your investments in the right accounts, you're essentially giving yourself a tax-optimized portfolio that works harder for your future.

Remember: asset allocation gets you in the game, but asset location helps you win it.

This blog post is intended for educational and informational purposes only. The views expressed are solely those of the author and do not represent professional financial advice. While every effort has been made to ensure the accuracy of the information presented, it should not be relied upon as a substitute for individualized advice from a qualified financial advisor. Financial decisions are complex and personal, and readers are strongly encouraged to conduct their own due diligence and seek professional guidance before making any investment or financial planning choices.

- Chris Maggio, Founder, Retirement Planning Partner, Kirkland, WA—providing fee-only retirement planning to clients in Seattle and across the US.