Buffered ETFs: Downside Protection at What Cost? Do They Fit in Your Strategy?

**Update 09-15-2025** After publishing this analysis, I realized I may have been too focused on the drawbacks without exploring when buffered ETFs actually make sense. Read my follow-up post: When Buffered ETFs Make Perfect Sense - The Capital Preservation Strategy for a different perspective on these products.

The market rollercoaster can be a wild ride, especially lately, leaving even seasoned investors feeling a bit queasy. That's where buffered investments, like buffered ETFs, can come into play, promising a smoother descent during market downturns. But, as with anything in finance, there's a trade-off. Let's delve into what these products are, their pros and cons, and whether they deserve a spot in your investment strategy.

What Are Buffered Index Investments?

Yes, buffered products are often structured as ETFs, but they can also take other forms, like structured notes or even unit investment trusts (UITs). The key is the "buffered" aspect, not necessarily the wrapper. ETFs are simply a common and accessible way to package these strategies.

Understanding Buffered Investments: The 10,000' View

Imagine a safety net for your investments. That's essentially what a buffered investment aims to provide. In a nutshell, they offer a pre-defined level of downside protection, typically over a specific period, the defined outcome period (e.g., one year). This protection comes at the cost of capping your potential upside gains. Think of it as trading some potential profit for a degree of peace of mind during market volatility.

How Do They Create the Buffer?

Buffered ETFs typically create their protection through sophisticated options strategies. Borrowing a term from Warren Buffet, the behind the scenes mechanisms may be best left to the "too hard pile". Here's a high-level description of how buffers may be created.

Options-Based Protection

The fund manager uses a portion of the portfolio to purchase put options, which increase in value when the underlying index falls. These puts provide the downside protection (the buffer). To offset the cost of these puts, the manager simultaneously sells call options on the same index, which limits the upside potential (creating the cap). This strategy is known as a "collar" in options terminology.

Structured Notes

Some buffered products use structured notes instead of options. These are debt securities whose return is tied to the performance of an underlying asset or index, with specific buffer and cap features built into the note's terms. The issuer of the note uses derivatives behind the scenes to create the buffer and cap features.

Different Types of Buffered Products

Buffered Index

This is the most common type. It offers a set percentage of downside protection (e.g., 10% or 20%) while also capping your potential gains; your upside exposure.

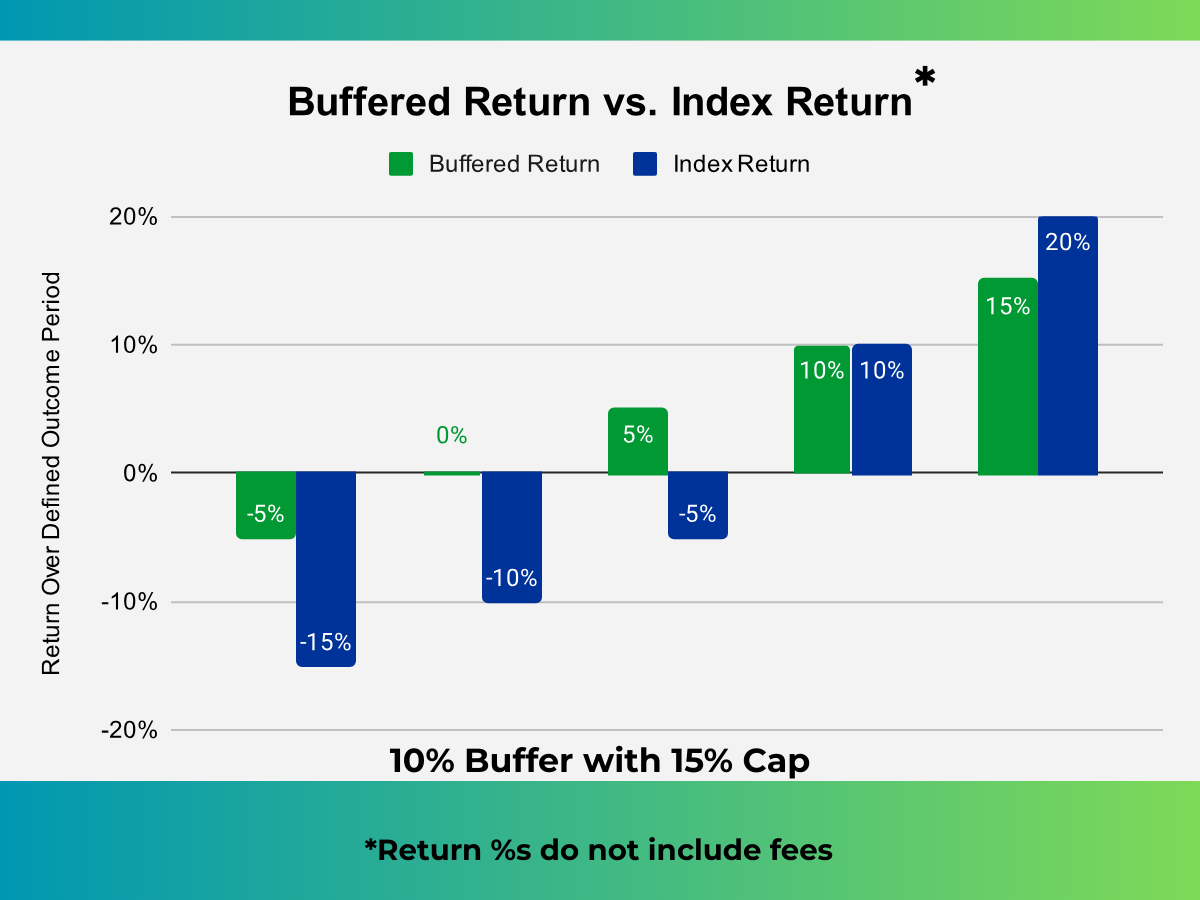

Real-world example: If you invest in a buffered ETF with a 10% buffer and a 15% cap, and the underlying index drops 15% during the outcome period, you would only lose 5% (the 15% market drop minus your 10% buffer). However, if the index rises 20%, your gains would be limited to 15% due to the cap (see chart below).

Dual Directional Buffered Index

These are more complex, offering protection against both upward and downward market swings, within specified ranges. They are less common and typically used in more specialized investment strategies.

Designed Income

Some buffered products are designed to provide a steady stream of income, often with a buffer against downside risk. These may be more suitable for income-focused investors or those in retirement who need regular cash flow while maintaining some market exposure.

Key Players in the Market

When looking at the most popular buffered ETFs, two prominent providers consistently stand out:

Innovator ETFs

They are well-known for their "Defined Outcome ETFs," which aim to provide specific downside protection and upside caps over a set period.

First Trust

They offer a range of "FT Vest Buffer ETFs" with various buffer levels and outcome periods.

Benefits of Buffered Investments

Limited Downside Losses

This is the primary appeal. You know, in advance, the maximum potential loss within the buffer, providing a level of predictability that traditional investments lack.

Percentage Protection

The buffer is usually expressed as a percentage, making it easy to understand the level of protection you're receiving. This transparency helps with investment planning.

Potential for 0% Loss

In some cases, if the market decline is within the buffer, you might experience no loss at all. However, this loss does not include fees. It is possible to lose principal even with the 100% downside protection model due to fees.

Drawbacks to Consider

Limited Upside Growth

The trade-off for downside protection is a cap on potential gains. In a bull market, you'll likely underperform the broader index, potentially by a significant margin.

Higher Costs

Buffered investments typically come with higher fees than traditional index ETFs, which can eat into your returns over time. These fees cover the complex options strategies and management required.

Critical Timing Requirements

Getting in at the execution date is crucial. If you buy or sell outside this window, you may not get the intended buffer or cap. This timing requirement adds complexity to what should be a straightforward investment.

Reduced Liquidity

While these products are often touted as liquid, it's wise to treat them more like a locked-in certificate of deposit (CD). Selling before the end of the term could result in losses or unexpected costs. Don't invest money you'll need access to before the outcome period ends.

No Income Component

Many buffered ETFs do not pay dividends even if they are indexed against another ETF (like SPY that does include a dividend yield). This means you miss out on an important component of total return.

Who Are Buffered ETFs For?

Buffered ETFs may shine for a specific type of investor: those who crave stock market participation but recoil at the thought of significant losses. Think of someone with a very low risk tolerance, who's always been hesitant to dive into the stock market's ups and downs.

You'll often hear about blending buffered ETFs with traditional stock and bond portfolios. But honestly, that approach can be a bit puzzling. If you're already diversified with standard stock ETFs and bonds, adding buffered ETFs might create unnecessary complexity and potentially limit your overall growth.

Instead, consider buffered ETFs as a replacement for your stock allocation, or stock ETFs, if market volatility keeps you up at night. They're a way to dip your toes into the stock market without the fear of a complete freefall. If you're the kind of investor who prioritizes capital preservation above all else, and you're willing to trade some potential upside for peace of mind, then buffered ETFs could be a good fit.

Important Considerations If You Decide to Invest

Avoid Automatic Rollovers

Look for buffered investments that don't automatically roll over. You want the flexibility to reassess your strategy at the end of the term, based on the current market conditions and your personal financial situation. This way, you can decide if reinvesting is still the right move.

Active Management Required

If you are a set it and forget it type of investor, buffered ETFs are probably not the investment tool for you. These investment vehicles require year over year monitoring; ensuring investments are made at the execution date and cash-outs or reinvestment decisions made at the end of the defined outcome period.

More Traditional Alternatives: Bonds and Bond Funds

Instead of opting for buffered products, consider a more traditional, and often more flexible, approach: diversifying your portfolio with bonds. By investing in low cost, non-buffered index funds, you maintain the potential for uncapped upside growth, and use bonds to smooth out the ride. Bonds, in general, tend to have a lower correlation with stocks. This means that when stocks decline, bonds may hold their value or even increase in value, acting as a counterbalance and potentially reducing overall portfolio volatility.

Understanding the Hedge

A "hedge" in investing is essentially a strategy used to mitigate potential losses. In the context of stocks, a hedge aims to reduce the risk of a market downturn significantly impacting your portfolio. Bonds can serve this purpose because they are generally considered less risky than stocks. When investors become fearful of a stock market decline, they often shift their capital into safer assets, like government bonds, driving their prices up.

Why Bonds Over Buffered Investments?

Flexibility and Liquidity

Unlike buffered investments, which often have specific terms and limited liquidity, bonds offer greater flexibility. You can buy and sell bonds as needed, allowing you to adjust your portfolio based on changing market conditions and your personal needs.

Transparency

Bonds are relatively straightforward financial instruments. Their characteristics, such as maturity date and interest rate, are clearly defined. Buffered investments, on the other hand, can be complex, with embedded options and other features that may be difficult to understand.

Cost Efficiency

Low-cost bond index funds or ETFs typically have lower expense ratios than buffered investments. Over the long term, these lower costs can significantly impact your returns.

Uncapped Upside

By investing in low-cost, non-buffered index funds for your stock allocation, you maintain the potential for uncapped upside growth. You aren't sacrificing potential gains for downside protection. The bonds are providing the downside protection.

Implementing the Strategy

To implement this strategy, you would typically allocate a portion of your portfolio to a diversified bond fund or ETF. The specific percentage of bonds will depend on your risk tolerance and investment goals. For example, a more conservative investor might allocate 60% to bonds and 40% to stocks, while a more aggressive investor might allocate 20% to bonds and 80% to stocks.

Bond Investment Considerations

Interest Rate Risk

Bond prices can fluctuate inversely with interest rates. When interest rates rise, bond prices tend to fall.

Credit Risk

There's always the risk that a bond issuer may default on its debt, particularly with corporate or municipal bonds.

Inflation Risk

The risk that inflation may erode the purchasing power of your bond returns, particularly with longer-term bonds in inflationary environments.

The Bottom Line: Making the Right Choice for Your Portfolio

When considering buffered ETFs, remember that financial markets rarely reward complexity. While these products offer an appealing promise—limiting downside while participating in market growth—the reality often falls short of expectations.

The allure of downside protection comes at significant costs: capped upside potential, higher fees, timing constraints, and complex structures that can be difficult to fully understand. Even with "protection," you may still face losses due to fees or mistimed entries and exits.

For most long-term investors, a simpler approach using traditional asset allocation—quality index funds paired with an appropriate bond allocation—often provides similar volatility reduction without the drawbacks. This time-tested strategy offers greater transparency, lower costs, flexibility to adjust as needed, and potentially better long-term returns.

Before considering buffered ETFs, ask yourself:

- Am I willing to monitor these investments annually and make timely decisions?

- Do I fully understand how the options strategies impact my returns in various market scenarios?

- Have I calculated the total cost impact over time compared to traditional alternatives?

- Does the psychological comfort of the buffer justify potentially leaving substantial returns on the table?

Remember, the most successful investment strategies are often the simplest ones. In the quest for downside protection, don't lose sight of your long-term financial goals and the proven paths to achieving them. The peace of mind promised by buffered products might actually come at too high a price.

This blog post is intended for educational and informational purposes only. The views expressed are solely those of the author and do not represent professional financial advice. While every effort has been made to ensure the accuracy of the information presented, it should not be relied upon as a substitute for individualized advice from a qualified financial advisor. Financial decisions are complex and personal, and readers are strongly encouraged to conduct their own due diligence and seek professional guidance before making any investment or financial planning choices.

- Chris Maggio, Founder, Retirement Planning Partner, Kirkland, WA—providing fee-only retirement planning to clients in Seattle and across the US.