Beware of Capital Gains: Why ETFs Could Save You Thousands More Than Mutual Funds

Quick Takeaway: ETFs typically generate fewer capital gains distributions than mutual funds, potentially saving you thousands in taxes and even lowering your future Medicare premiums. For a $100,000 portfolio, a mutual fund might distribute 3-5% in capital gains annually (regardless of market performance), costing you $450-$750 in taxes at a 15% rate, while a comparable ETF might distribute just 0.0-1%, resulting in $0-$150 in taxes.

Investing in the stock market is a powerful way to grow your wealth over time. Whether you're a seasoned investor or just starting, understanding the tax implications of your investment choices is super important. Today, we're looking at something that matters a lot for your regular (taxable) brokerage accounts: capital gains and how they differ between mutual funds (MFs) and exchange-traded funds (ETFs).

Real-World Impact

Consider two investors, both with $100,000 in identical S&P 500 index investments in taxable accounts:

- Investor A (Mutual Fund): Receives $3,000 in capital gains distributions at year-end, triggering $450 in taxes (at 15% rate).

- Investor B (ETF): Receives only $500 in capital gains distributions, resulting in just $75 in taxes.

Over 10 years, this difference adds up significantly—potentially saving thousands in taxes for the ETF investor, all while holding essentially the same investments!

What Exactly is a Capital Gain? And What Are the Thresholds?

Simply put, a capital gain is the profit you make when you sell an asset, like stocks, bonds, or shares of a fund, for more than you bought it for. The difference between your selling price (the proceeds) and your purchase price (your cost basis) is your capital gain.

The tax rate you pay on your capital gains depends on two main factors:

Holding Period

- Short-term capital gains: For assets held for one year or less, the profit is taxed at your ordinary income tax rate.

- Long-term capital gains: For assets held for more than one year, the profit is taxed at preferential long-term capital gains rates, which are generally lower than ordinary income tax rates.

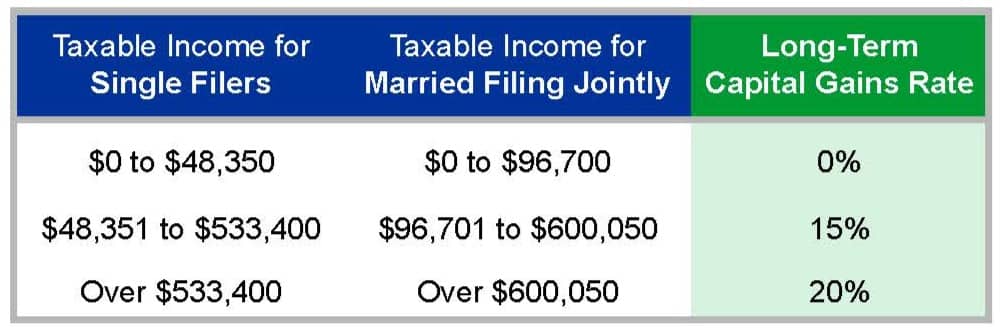

Income Brackets

Your taxable income determines which capital gains tax rate applies to you. Here are the federal long-term capital gains tax rates for 2025:

What this means: If your total taxable income (including capital gains) falls within the lowest bracket, you'll pay zero federal taxes on your long-term capital gains—a powerful incentive for tax planning!

Note: There's also a 3.8% Net Investment Income Tax (NIIT) that can apply to higher-income individuals.

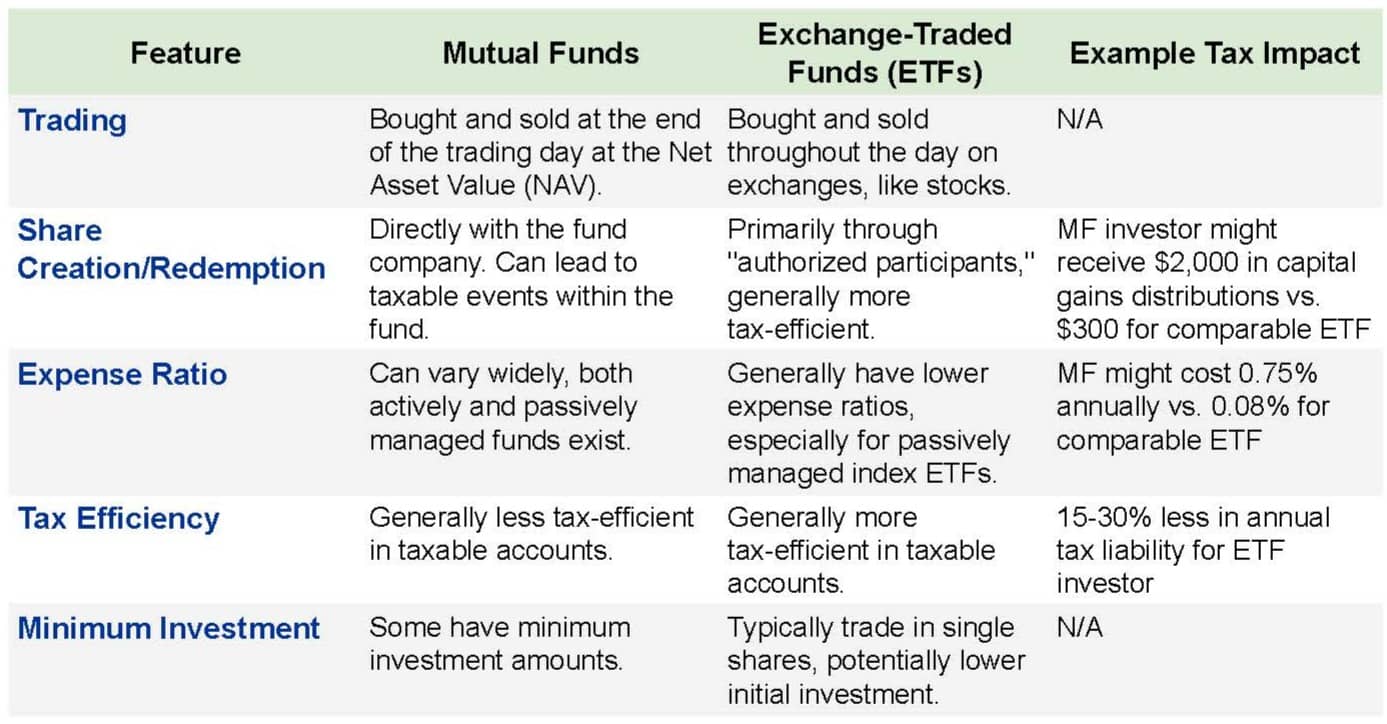

Mutual Funds vs. ETFs: Understanding the Key Differences

Before we get into the capital gains issue, let's recap the similarities and differences between mutual funds and ETFs:

Similarities:

- Diversification: Both MFs and ETFs allow you to invest in a diversified portfolio of assets, reducing individual stock risk.

- Professional Management: Most MFs and ETFs are managed by professional investment teams.

- Variety of Strategies: Both offer options that track various market indexes (like the S&P 500), focus on specific sectors, or employ active investment strategies.

Key Differences:

The Capital Gains Problem: Why Mutual Funds Often Generate More Taxable Events

Here's the main issue: mutual funds, because of how they're structured, can generate taxable capital gains for their shareholders even if those shareholders haven't sold any shares themselves. This happens much less often with ETFs.

Why Mutual Funds Generate More Taxable Events:

- Forced Sales: When mutual fund investors sell their shares, the fund manager often needs to sell underlying securities to raise cash for those redemptions. If these sales result in profits, the fund must distribute these capital gains to all shareholders—even those who didn't sell anything!

- Less Control: As a mutual fund shareholder, you have almost no control over when these internal sales and subsequent taxable distributions happen.

- Year-End Surprise: Many investors are shocked to receive substantial capital gains distributions in December, requiring tax payments even in years when their fund's performance was flat or negative.

An Important Mutual Fund Potential Advantage:

While ETFs generally offer better tax efficiency, mutual funds do have one potential tax advantage: active tax management. Skilled mutual fund managers can proactively harvest tax losses within the fund throughout the year, offsetting gains and potentially reducing the overall tax burden for shareholders. This strategic tax-loss harvesting within the fund structure is something most ETFs (particularly passive index ETFs) don't typically do to the same degree. For investors in higher tax brackets who select tax-aware active mutual funds, this benefit can sometimes outweigh the structural tax advantages of ETFs, especially in volatile markets that create more tax-loss harvesting opportunities.

Why ETFs Are More Tax-Efficient:

- Creation/Redemption Process: ETFs use a unique process involving "authorized participants" who exchange baskets of securities directly with the ETF, often avoiding triggering taxable sales within the fund.

- In-Kind Transfers: ETFs can often transfer low-cost-basis securities "in-kind" when handling large redemptions, avoiding realizing gains.

- Lower Turnover: Many ETFs, particularly index-based ones, have lower portfolio turnover, generating fewer capital gains events.

Why This REALLY Matters: The MAGI Connection!

The higher capital gains generated by mutual funds in taxable accounts create a ripple effect that goes beyond just your immediate tax bracket. It can significantly impact your Modified Adjusted Gross Income (MAGI).

Here's why this is super important:

- Tax Bracket Impact: Capital gains distributions increase your taxable income, potentially pushing you into a higher tax bracket.

- Medicare Premiums (Once You're 65+): Your MAGI directly determines your Medicare Part B and Part D premiums. Higher MAGI can trigger Income-Related Monthly Adjustment Amounts (IRMAA), resulting in substantially higher healthcare costs in retirement.

Real-world example: A retiree whose MAGI exceeds the standard threshold by just $1 could pay up to $800 more annually in Medicare premiums. Capital gains distributions from mutual funds can unexpectedly push retirees over these thresholds, creating a "Medicare tax cliff."

Four Strategies for More Tax-Efficient Investing

Given these capital gains considerations, here are four actionable strategies:

- Prioritize ETFs in Taxable Accounts: For your regular brokerage accounts, favor ETFs over actively managed mutual funds, especially those with high turnover histories. Their inherent tax efficiency helps minimize taxable events and preserves more of your investment gains.

- Keep Mutual Funds in Tax-Advantaged Accounts: If you prefer certain mutual funds, hold them within tax-advantaged accounts like Traditional or Roth IRAs, or 401(k)s. Within these accounts, capital gains distributions aren't taxed annually.

- Compare Expense Ratios: Always check the expense ratio—the annual fee charged to operate the fund. A difference of just 0.50% can dramatically impact long-term returns. For example, on a $100,000 investment growing at 7% annually, a 0.75% vs. 0.15% expense ratio difference equals approximately $30,000 in additional costs over 20 years!

- Implement Tax-Loss Harvesting: In taxable accounts, strategically sell investments that have declined in value to offset capital gains from other investments. This can significantly reduce your taxable investment income while maintaining your overall investment strategy.

Your Action Plan

- Review your current holdings: Identify which investments are in taxable vs. tax-advantaged accounts.

- Check distribution history: Look at the capital gains distribution history of your mutual funds (available on fund websites).

- Consider gradual transitions: If you have large unrealized gains in mutual funds, plan a strategic transition to more tax-efficient options.

- Consult a tax professional: Every investor's situation is unique—consider getting personalized advice before making significant changes.

The Bottom Line: Small Changes, Big Long-Term Impact

Understanding the differences in capital gains between mutual funds and ETFs in taxable accounts isn't just small stuff—it's a crucial part of smart investing that can save you thousands over your lifetime.

By being strategic about which investment vehicles you choose for different account types, you can potentially reduce your tax burden both now and in the future, ultimately keeping more of your hard-earned investment returns working for you.

What tax-efficient changes might you make to your investment strategy this year?

This blog post is intended for educational and informational purposes only. The views expressed are solely those of the author and do not represent professional financial advice. While every effort has been made to ensure the accuracy of the information presented, it should not be relied upon as a substitute for individualized advice from a qualified financial advisor. Financial decisions are complex and personal, and readers are strongly encouraged to conduct their own due diligence and seek professional guidance before making any investment or financial planning choices.

- Chris Maggio, Founder, Retirement Planning Partner, Kirkland, WA—providing fee-only retirement planning to clients in Seattle and across the US.