When Buffered ETFs Make Perfect Sense - The Capital Preservation Strategy

After publishing my original analysis of buffered ETFs, I realized I may have been too focused on their limitations without fully exploring one of their most compelling use cases: capital preservation and volatility reduction for investors approaching or in the early years of retirement.

[If you haven't read my original post on buffered ETFs, I recommend starting there for a comprehensive overview of how these products work and their general drawbacks: Link to Original Post

Reframing the Discussion: Protection vs. Growth

While my original post highlighted the drawbacks of buffered ETFs for traditional accumulation-phase investors, there's an entirely different lens through which to view these products. For investors approaching retirement or in their early retirement years, the investment equation fundamentally changes - it's no longer just about maximizing growth, but about managing sequence of returns risk and reducing volatility during the most vulnerable financial period.

The Critical Retirement Transition Period

The years leading up to and immediately following retirement represent the highest-risk period for portfolio longevity. This isn't just about having "won the game" - it's about navigating the period when market volatility can have the most devastating long-term impact:

Pre-retirement (5-10 years out): Large portfolio balances combined with continued contributions mean that market downturns can create significant absolute dollar losses, potentially delaying retirement plans.

Early retirement (years 1-10): This is when sequence of returns risk is most dangerous. Poor market performance during this period, combined with portfolio withdrawals, can permanently impair a portfolio's ability to sustain retirement spending - even if markets eventually recover.

The Full Spectrum of Capital Preservation Needs

Buffered ETFs serve multiple investor profiles who share a common need for downside protection, but for different reasons:

The Near-Retiree: Someone 5-10 years from retirement who has accumulated substantial assets but cannot afford a major market downturn that could delay their retirement timeline. They're still building wealth but need to protect what they've accumulated.

The New Retiree: Someone in their first decade of retirement who needs to navigate the dangerous sequence of returns period while maintaining some growth potential. Market volatility during this period can permanently impair portfolio longevity.

The Overfunded Retiree: Someone who has definitively "won the game" - they've accumulated sufficient wealth for their retirement needs, reached their financial independence number, and prioritize preserving what they've built over maximizing additional gains. They want to maintain some equity exposure but don't need to take significant risks given their financial position.

For all these investor profiles, the focus shifts from pure wealth accumulation to managing downside risk while maintaining some upside participation. Whether driven by sequence of returns concerns or simple capital preservation goals, buffered ETFs can serve as valuable tools during these critical periods.

Why Buffered ETFs Excel at Capital Preservation

Asymmetric Risk Management

When your primary goal is protecting what you have rather than growing it aggressively, the "capped upside" criticism becomes less relevant. A retiree might be perfectly content with 10-15% annual gains if it means avoiding the psychological and financial impact of a 20-30% market crash.

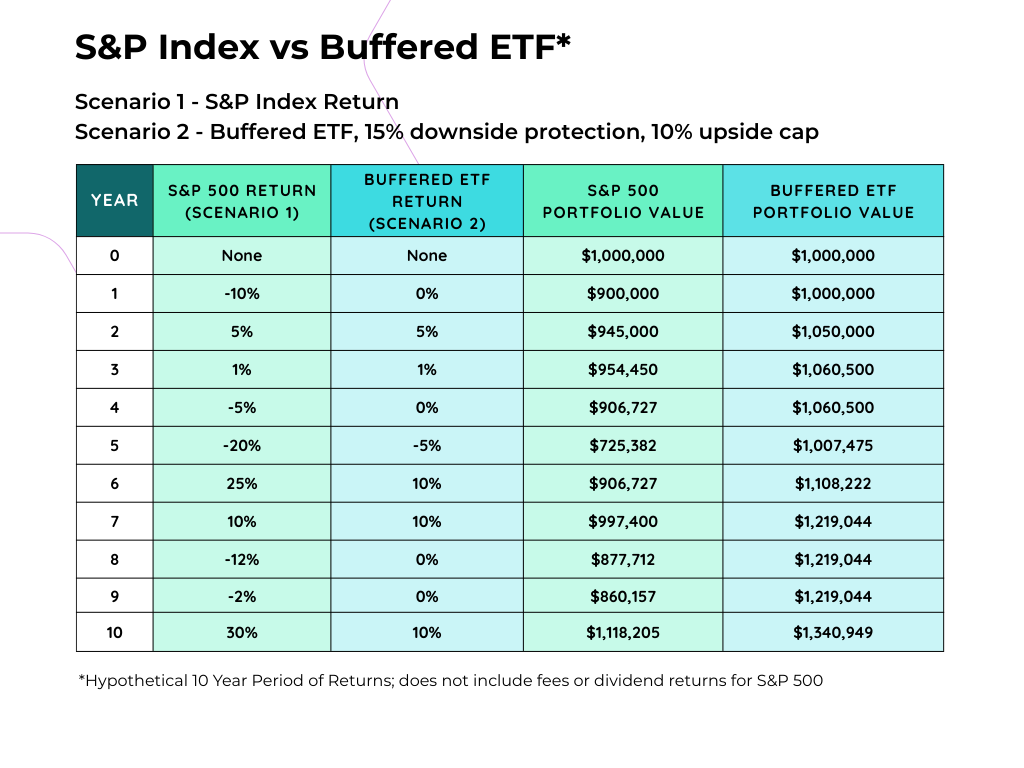

Sequence of Returns Protection

For retirees or near-retirees, the sequence of returns risk is particularly dangerous. A major market decline early in retirement can devastate a portfolio's longevity, even if markets eventually recover. Buffered ETFs can provide crucial protection during this vulnerable period.

Maintaining Equity Exposure with Peace of Mind

Rather than fleeing to ultra-conservative investments like CDs or money market funds (which may not keep pace with inflation), buffered ETFs allow preservation-focused investors to maintain meaningful equity exposure while sleeping soundly at night.

Practical Applications for Capital Preservation

The Bridge Strategy

Buffered ETFs work well as a "bridge" investment during market uncertainty. They protect assets during volatile periods, maintain upside participation if markets rise, and allow for transitions back to traditional investments when conditions improve.

Core-Satellite Approach for Retirees

This approach uses buffered ETFs as core holdings that provide stability and modest growth, while small satellite allocations to higher-growth investments add additional upside potential.

Glide Path Implementation

Similar to how target-date funds increase bond allocations as investors approach retirement, buffered ETFs can be incorporated into a dynamic allocation strategy:

- Pre-retirement: Gradually increase buffered ETF allocation as you approach retirement, replacing some traditional equity exposure

- Early retirement (years 1-10): Maximize buffered ETF allocation during the period of highest sequence of returns risk, when spending is typically higher and portfolio sustainability is most vulnerable

- Later retirement: After navigating the critical early retirement years, investors may choose to reduce buffered ETF allocations in favor of more traditional investments if their financial security is well-established

This flexible approach recognizes that risk tolerance and financial priorities change throughout different phases of retirement.

Laddering Strategy for Enhanced Liquidity

One of the criticisms of buffered ETFs is their reduced liquidity due to the defined outcome periods. However, investors can create their own flexibility through a "laddering" approach by distributing investments across buffered ETFs with different outcome period end dates throughout the calendar year. For example, you could allocate portions to products with outcome periods ending in March, June, September, and December. This creates quarterly opportunities to reassess and access funds without sacrificing the buffer protection, provides flexibility to evaluate market conditions and personal needs multiple times per year, and allows for strategic rebalancing or cash access without disrupting the entire buffered portfolio. This laddering strategy transforms what appears to be an inflexible investment into a more liquid, manageable approach while maintaining the core benefits of downside protection.

Addressing the Original Concerns in a Preservation Context

"Limited Upside Growth" - Actually a Feature

For preservation-focused investors, capped gains of 10-15% annually may be entirely adequate. The goal isn't to maximize returns but to avoid catastrophic losses while maintaining purchasing power.

"Higher Costs" - Worth It for Peace of Mind

While fees are always a consideration, the premium may be justified if it prevents panic selling during market downturns or allows for better sleep and life enjoyment during retirement.

"Timing Requirements" - Manageable with Proper Planning

Annual monitoring and strategic entry/exit decisions become part of active retirement planning rather than a burden for set-and-forget investors.

When Buffered ETFs Are the Right Choice

Consider buffered ETFs if you:

- Have achieved your core financial goals

- Cannot afford significant portfolio losses

- Want to maintain some equity exposure

- Value predictability over maximum returns

- Are comfortable with active annual decision-making

- Prioritize capital preservation over wealth accumulation

The Bottom Line: Context Matters

My original analysis focused primarily on accumulation-phase investors, where traditional diversified portfolios often provide better long-term results. However, for investors in the preservation phase of their financial journey, buffered ETFs can serve as valuable tools in the right circumstances.

The key is matching the investment tool to your specific situation and goals. If you've already won the financial game and your primary objective is protecting what you've built while maintaining some growth potential, buffered ETFs deserve serious consideration as part of a comprehensive capital preservation strategy.

This blog post is intended for educational and informational purposes only. The views expressed are solely those of the author and do not represent professional financial advice. While every effort has been made to ensure the accuracy of the information presented, it should not be relied upon as a substitute for individualized advice from a qualified financial advisor. Financial decisions are complex and personal, and readers are strongly encouraged to conduct their own due diligence and seek professional guidance before making any investment or financial planning choices.

- Chris Maggio, Founder, Retirement Planning Partner, Kirkland, WA—providing fee-only retirement planning to clients in Seattle and across the US.