ESPP Strategy: The Smart Way to Lock in Guaranteed Returns

ESPP Strategy: The Smart Way to Lock in Guaranteed Returns

Are you making the most of your employee benefits? If your company offers an Employee Stock Purchase Plan (ESPP) and you're not participating, you're potentially leaving money on the table. I'm not talking about the traditional "buy and hold" approach that most people associate with company stock. Instead, I want to share a strategic approach that can deliver guaranteed returns with minimal risk.

What Makes an ESPP So Powerful?

An ESPP allows employees to purchase company stock at a discounted price, often through convenient payroll deductions, with discounts typically up to 15% off the market price. But here's where it gets interesting: most plans allow you to sell immediately after purchase, effectively locking in that discount as pure profit.

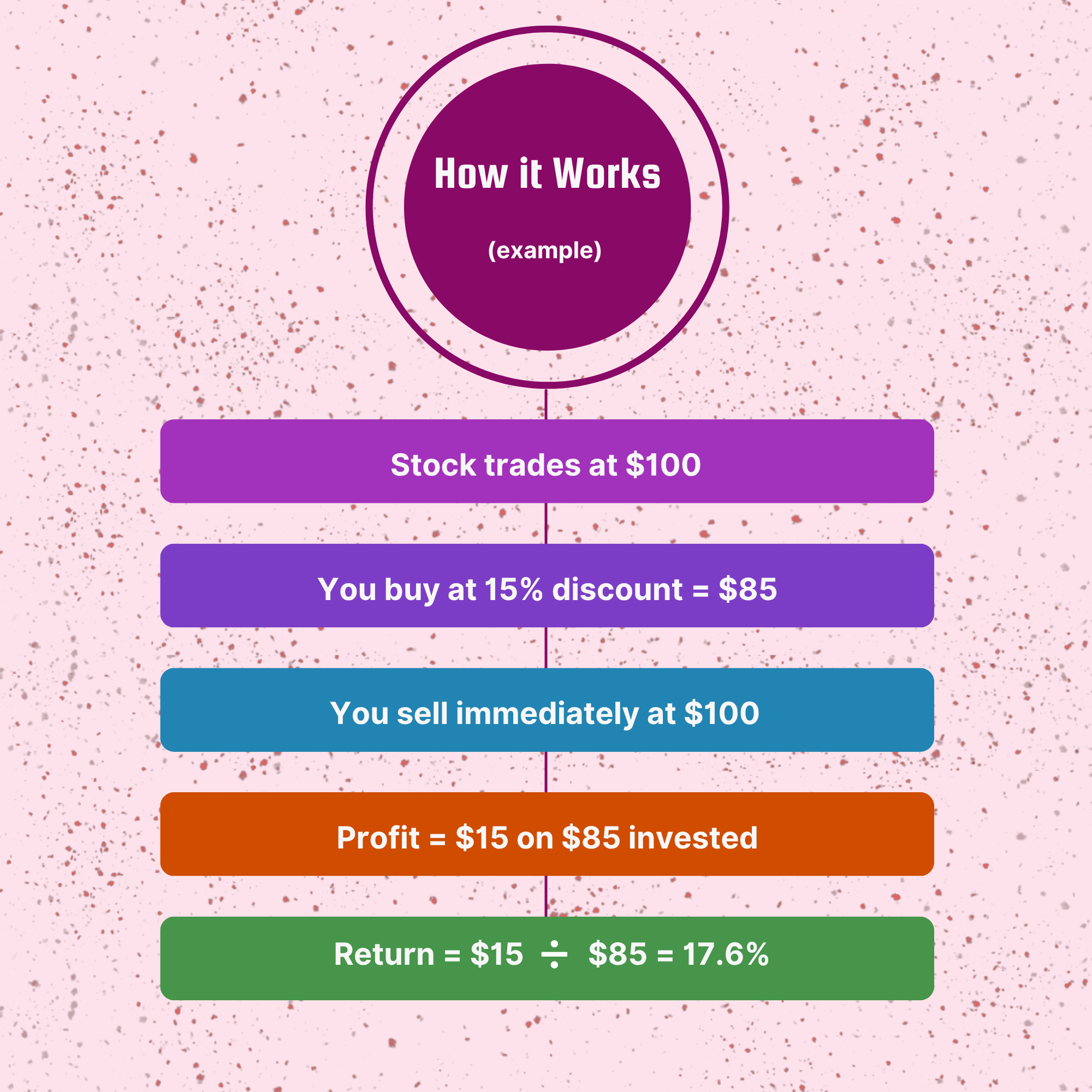

Think about it: where else can you find an investment that guarantees a minimum 18% return? With immediate sales, assuming a 15% discount, you can lock in a minimum 17.6% pre-tax gain on your money. That's not speculation or market timing—that's math.

The Strategy: Buy and Sell Immediately

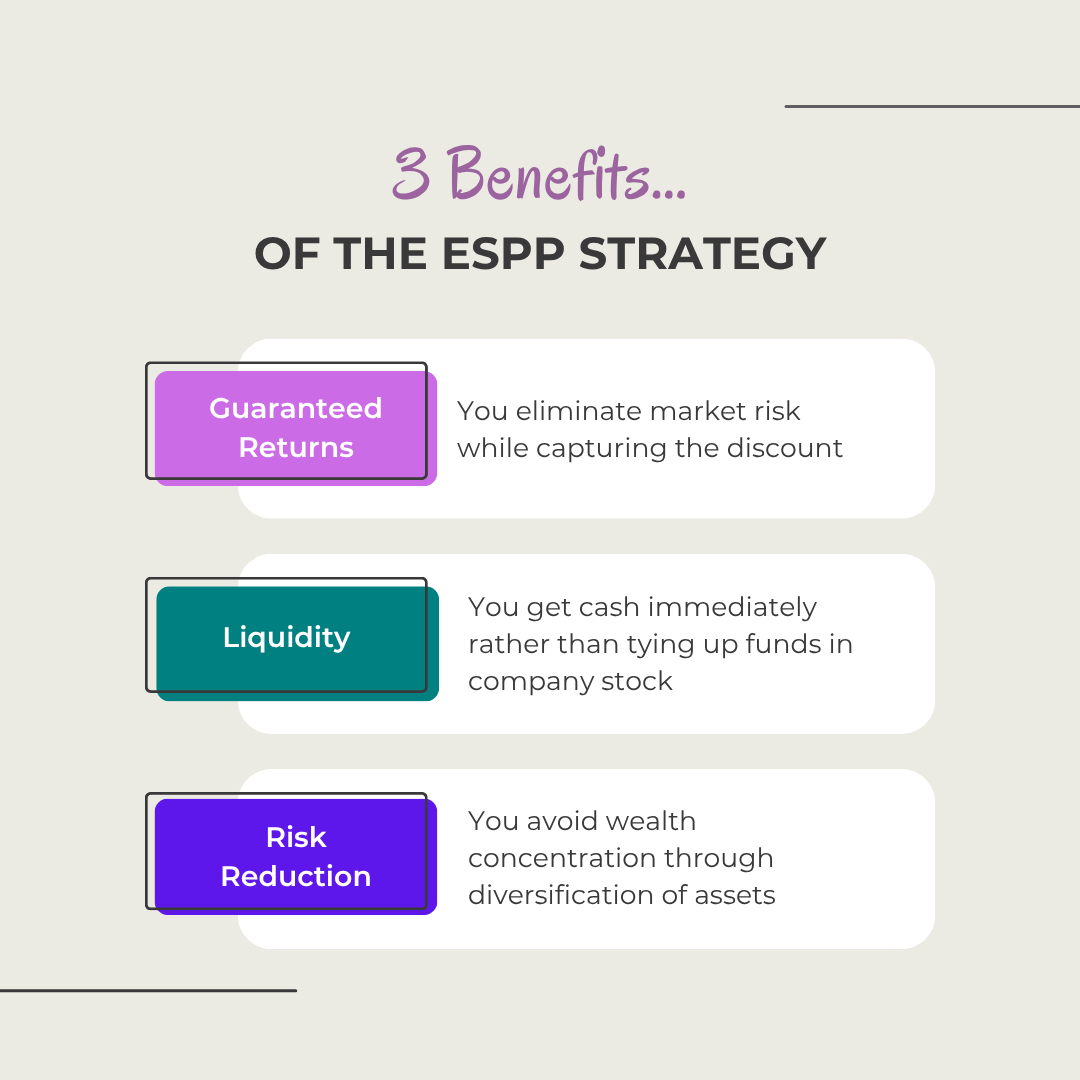

The key insight many employees miss is that you don't need to hold onto the stock to benefit from an ESPP. In fact, the immediate sale strategy often makes the most financial sense because:

Why Immediate Sales Actually Reduce Your Risk

Here's something most people don't consider: your financial well-being is already heavily tied to your company's success. Your salary, benefits, career advancement, and retirement contributions all depend on your employer's continued prosperity. When you add company stock to this equation, you're essentially putting all your financial eggs in one basket.

Think about it this way: if your company hits hard times, you could simultaneously face job loss, reduced benefits, and a plummeting stock price. That's a triple hit to your financial security. By selling your ESPP shares immediately, you're actively diversifying away from this concentration risk.

The cash you generate from immediate ESPP sales gives you options. You can:

This strategy transforms your ESPP from a concentration risk into a diversification tool. You're essentially using your company's generosity (the discount) to build wealth that's independent of your company's fate. That's smart risk management.

Here's how the process typically works: Contributions accumulate over a set offering period, usually six months to a year. At the end of this period, the company uses the accumulated funds to buy shares on behalf of employees, typically at a discount of up to 15% off the market price. Many plans also include a "lookback" feature, which means the discount is calculated from whichever stock price is lower—either at the beginning or end of the purchase period.

The Lookback Advantage: When Returns Get Even Better

The lookback provision can dramatically increase your returns when your company's stock price rises during the offering period. Here's a real example of how powerful this can be:

The lookback provision essentially gives you the best of both worlds: protection if the stock falls (you get the lower end price) and amplified gains if the stock rises (you get the lower starting price). It's this feature that can turn a good ESPP into an exceptional wealth-building tool.

Understanding the Tax Implications

Now, let's address the elephant in the room: taxes. When you sell ESPP shares immediately, because you're selling within one year of purchase, you'll be taxed at ordinary income rates on the discount.

The difference between the actual price you paid for the shares and the purchase date price is subject to ordinary income tax rates. While this means you'll pay taxes on your gains at your regular tax rate rather than the lower capital gains rate, remember that you're still capturing a guaranteed return that's hard to find elsewhere in the market.

Getting Started: The Practical Steps

Employees typically can contribute up to $25,000 per calendar year to their ESPP, though your company may set lower limits. Here's what you need to know:

Enrollment periods: ESPPs have specific enrollment windows, often once or twice a year. Mark these dates on your calendar—missing them means waiting until the next enrollment period.

Contribution limits: You'll decide what percentage of your salary to contribute, up to your plan's maximum. The automatic payroll deduction system makes it easy to consistently participate in each offering period without having to remember to set aside funds manually.

Purchase periods: At the end of each purchase period, your accumulated contributions buy company stock at the discounted price.

Immediate sale: Once the shares are in your account, you can typically sell them right away to lock in your gains.

The Bottom Line

Your company's ESPP isn't just another employee benefit—it's a wealth-building tool that can provide guaranteed returns when used strategically. While holding company stock long-term might align with your investment philosophy, the immediate sale strategy offers a low-risk way to capture consistent gains.

The beauty of this approach is its simplicity and predictability. You're not trying to time the market or predict your company's future performance. You're simply taking advantage of a mathematical advantage built into your benefits package.

Taking Action

Ready to get started? Check your company's HR portal or benefits website for enrollment details and deadlines. Don't wait—enrollment periods have specific windows, and once they close, you'll have to wait for the next opportunity.

If you have questions about your specific plan details, reach out to your HR or benefits team. Every ESPP is slightly different, so understanding your plan's particular features like lookback provisions, holding periods, and contribution limits will help you maximize your strategy.

Remember, this isn't about getting rich quick or making speculative bets. It's about systematically capturing guaranteed returns that are sitting right there in your benefits package. In a world where guaranteed returns are increasingly rare, your ESPP might be one of the best risk-adjusted investments available to you.

Take advantage of this opportunity and start putting your employee benefits to work for your financial future. It's a smart decision that can compound over time, one purchase period at a time.

This blog post is intended for educational and informational purposes only. The views expressed are solely those of the author and do not represent professional financial advice. While every effort has been made to ensure the accuracy of the information presented, it should not be relied upon as a substitute for individualized advice from a qualified financial advisor. Financial decisions are complex and personal, and readers are strongly encouraged to conduct their own due diligence and seek professional guidance before making any investment or financial planning choices.

- Chris Maggio, Founder, Retirement Planning Partner, Kirkland, WA—providing fee-only retirement planning to clients in Seattle and across the US.