Maximize Your Savings: Understanding the Mega Backdoor Roth 401(k)

If you’ve already maxed out your standard 401(k) and are looking for additional ways to protect more of your future retirement income from taxes, the Mega Backdoor Roth is one of the most powerful strategies available to high earners. And with higher limits in 2026, it becomes even more valuable.

The 2026 Numbers You Need to Know

The IRS allows a very large total contribution to your 401(k) plan each year. This total includes your own contributions, your employer match, and any after‑tax contributions you make.

- Under Age 50: The combined limit under Section 415(c) is $72,000.

- Age 50 or Older: You can make an $8,000 catch‑up contribution. This catch‑up is added on top of the base limit, making your absolute maximum $80,000.

To put this in perspective:

- Your standard elective deferral limit (pre-tax or Roth) is $24,500 ($32,500 if 50+).

- Everything above that amount, up to that $72k or $80k ceiling, is where the "Mega" strategy lives.

How the Mega Backdoor Roth Works

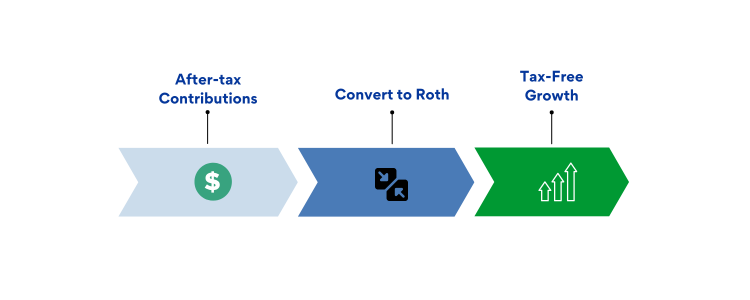

The Mega Backdoor Roth is a two‑step process that uses the “after‑tax” portion of your 401(k) plan.

Step 1: Make After‑Tax Contributions Once you hit your $24,500 limit (or $32,500 if 50+), you contribute to the "after‑tax" bucket of your 401(k).

Example: A 55-year-old contributes $32,500 and gets a $10,000 match. They still have $37,500 of "space" left before hitting the $80,000 cap. They can contribute that remaining amount as after-tax dollars.

Step 2: Convert to Roth You move those after-tax dollars into a Roth IRA or Roth 401(k). Because you already paid taxes on the principal, the conversion is generally tax‑free.

Why the "Pro-Rata Rule" Won't Stop You

If you’ve heard of the Backdoor Roth IRA, you may have heard of the dreaded Pro-Rata Rule. This rule usually triggers a surprise tax bill if you have other pre-tax money in a Traditional or Rollover IRA.

The 401(k) Advantage: The Mega Backdoor Roth is generally immune to your outside IRA balances because of how the IRS views "buckets":

- IRA Backdoor: The IRS looks at all your IRAs as one big bucket. If you have $100k in a Rollover IRA, you cannot just convert a "clean" after-tax contribution; the IRS forces you to convert a proportional amount of your taxable pre-tax money.

- 401(k) Mega Backdoor: The IRS allows you to isolate the after-tax sub-account specifically within your 401(k). You can convert only those dollars without being forced to pull from your pre-tax 401(k) balance or your outside Rollover IRAs.

The Result

Once the money lands in a Roth account, all future growth and all future withdrawals are 100% tax‑free. For high earners, this is the most efficient way to move tens of thousands of dollars per year into a tax-free environment.

Is Your Plan "Mega" Ready?

It is important to note that the Mega Backdoor Roth is not a standard feature in every retirement plan. Because these rules are optional for employers, you must verify that your specific 401(k) supports the strategy. To pull this off, your plan must allow for after-tax (non-Roth) contributions and either "in-service distributions" to an outside Roth IRA or "in-plan Roth conversions." Before you start, check your Summary Plan Description (SPD) or contact your plan administrator directly. You can simply ask: "Does my plan allow for after-tax contributions and in-service Roth conversions?" If they don't offer these specific features, you won't be able to utilize the "Mega" strategy, even if you have the extra cash to save.

Final Note for 2026: If you earned over $150,000 in 2025, the IRS now requires your $8,000 catch-up to be "Roth." This doesn't change your total limit, but it does mean you can't take a tax deduction on that specific catch-up slice!

This blog post is intended for educational and informational purposes only. The views expressed are solely those of the author and do not represent professional financial advice. While every effort has been made to ensure the accuracy of the information presented, it should not be relied upon as a substitute for individualized advice from a qualified financial advisor. Financial decisions are complex and personal, and readers are strongly encouraged to conduct their own due diligence and seek professional guidance before making any investment or financial planning choices.

- Chris Maggio, Founder, Retirement Planning Partner, Kirkland, WA—providing fee-only retirement planning to clients in Seattle and across the US.