Retirement Income Strategies: Finding Your "Perfect" Approach

Introduction

Planning for retirement income can be overwhelming with numerous strategies recommended by financial advisors, pundits, and fellow retirees. Each approach comes with its own set of advantages and limitations. The key is finding the strategy that aligns best with your personal circumstances, risk tolerance, and retirement vision. This article examines four popular retirement income strategies—the 4% Rule, Bucketing Approach, Safety-First Approach, and Bond Tent Strategy—outlining how each works and their respective pros and cons to help you determine which might work best for your situation.

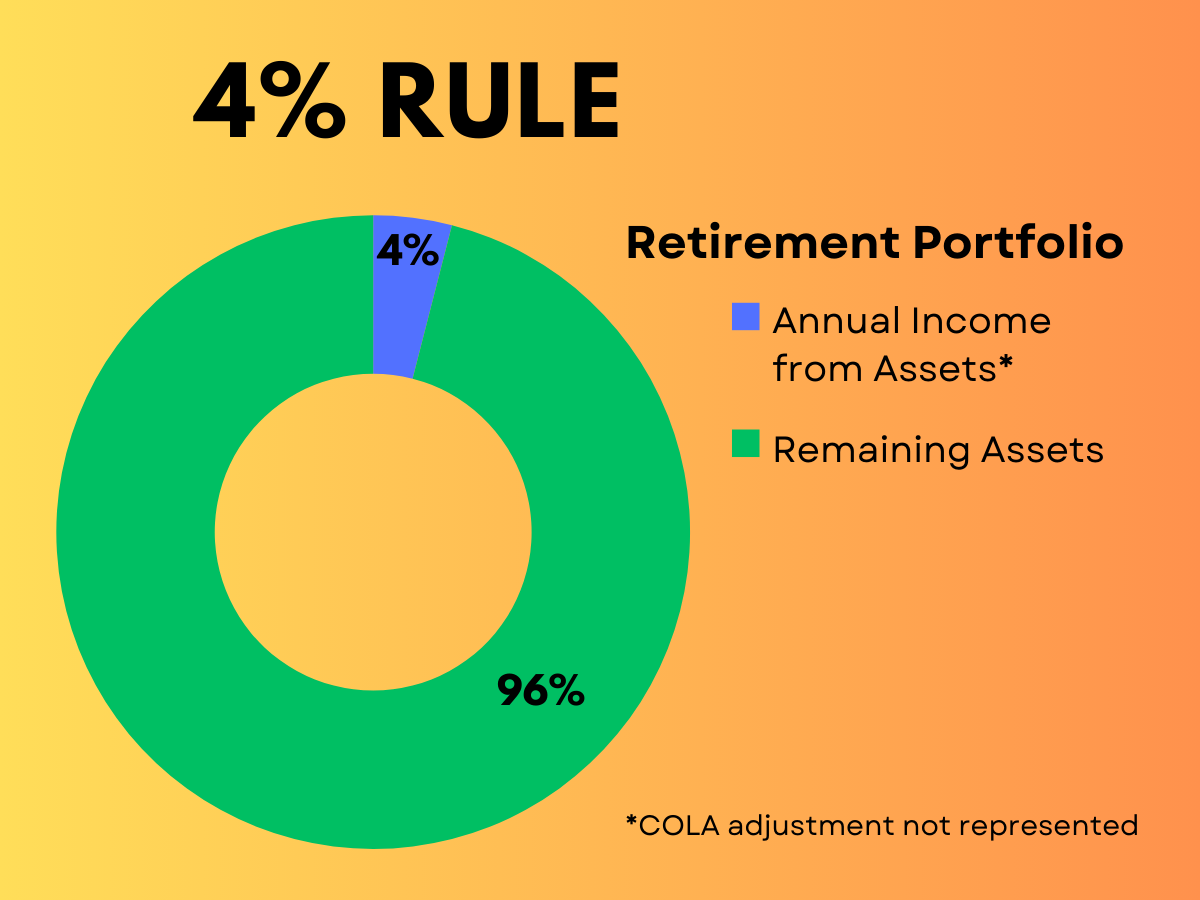

The 4% Rule

How It Works

The 4% Rule is one of the most well-known retirement withdrawal strategies. Developed by financial advisor William Bengen in the 1990s, it suggests withdrawing 4% of your retirement portfolio in the first year, then adjusting that amount annually for inflation in subsequent years. This approach was developed through back-testing historical market data to determine a "safe" withdrawal rate that would allow retirement funds in a balanced portfolio (50% to 75% in stocks and 25% to 50% in intermediate-term Treasury bonds)) to last at least 30 years.

Pros

- Simplicity: Straightforward to understand and implement without complex calculations

- Clear planning target: Provides a concrete savings goal (25x your estimated annual expenses)

- Flexibility: Can be adjusted based on personal risk tolerance (some may use 3.5% or 3% for added safety)

- Objectivity: Removes emotional decision-making from withdrawal planning

Cons

- Sequence of Returns Risk: If your portfolio experiences significant losses in the early years of retirement while you're making withdrawals, it can deplete your assets faster than anticipated and may never recover

- Inflexible Spending: Doesn't account for varying spending needs throughout retirement (many retirees spend more in early "go-go" years than later years)

- Time Limitation: Originally designed for a 30-year retirement horizon—may not be suitable for those who live longer

- Historical Dependency: Based on past market performance, which may not reflect future conditions

- Market Assumptions: Best outcome was in a balanced portfolio (50% to 75% in stocks and 25% to 50% in intermediate-term Treasury bonds) but may not account for extremely volatile markets

Guard Rails Variation

A popular modification to the traditional 4% rule is the "Guard Rails" approach, developed by financial researcher Jonathan Guyton and mathematician William Klinger. This strategy introduces spending adjustment rules based on portfolio performance:

- If your portfolio drops significantly, you reduce spending temporarily (typically by 10%)

- If your portfolio performs exceptionally well, you can increase spending

- Specific percentage triggers (typically 20% above or below initial withdrawal rate) determine when to adjust

This dynamic approach helps address the rigid nature of the standard 4% rule by allowing spending to flex with market conditions, potentially extending portfolio longevity while enabling more spending during good market periods.

However, there's a significant downside to the Guard Rails approach: it may lead to underspending during precious retirement years. By cutting expenses during market downturns, you might forgo meaningful experiences and activities during healthy, active years. Time is limited in retirement, and reducing spending could mean missing opportunities for travel, hobbies, or family experiences that may not be possible later due to health limitations. This psychological and quality-of-life cost is an important consideration when implementing spending adjustments based on market performance.

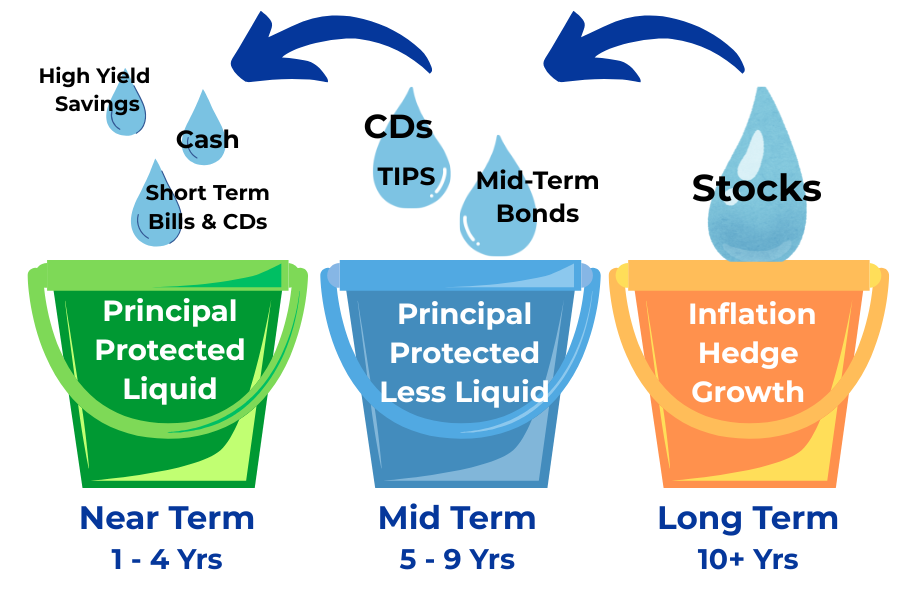

Bucketing or Time-Segmented Approach

How It Works

This strategy divides retirement assets into different "buckets" or time segments, each with its own investment approach based on when you'll need the money. Near-term buckets (1-4 years) are invested conservatively in cash equivalents, while mid-term buckets (5-9 years) might contain bonds, and long-term buckets (10+ years) hold growth investments like stocks.

Pros

- Mental Clarity: Creates a clear visual separation of funds based on when they'll be needed

- Reduced Emotional Reactions: Having near-term needs secured can prevent panic selling during market downturns

- Customizable Time Frames: Can be tailored to your specific retirement spending phases

- Balanced Approach: Combines safety for immediate needs with growth potential for future expenses

- Natural Inflation Hedge: Long-term buckets invested in equities can help offset inflation

Cons

- Persistent Sequence Risk: Still vulnerable to sequence of returns risk when replenishing buckets

- Replenishment Challenges: Difficult decisions about when to sell growth assets to refill shorter-term buckets

- Psychological Barriers: May be emotionally challenging to sell investments during market downturns to refill buckets

- Management Complexity: Requires more active management and rebalancing than simpler approaches

- Potential Cash Drag: Having significant assets in cash for near-term buckets might reduce overall returns

Safety-First or Flooring Approach

How It Works

This strategy, examined by economists Zvi Bodie, Robert Merton, and Paul Samuelson, and popularized more recently by Dr. Wade Pfau, is also known as the "Flooring Approach." It prioritizes covering essential expenses with guaranteed income sources. It starts by calculating your basic living expenses (food, shelter, healthcare, utilities, taxes) and ensuring these are covered by reliable income streams like Social Security, pensions, and annuities. Only after securing these essentials would you invest remaining assets for discretionary spending.

Pros

- Peace of Mind: Ensures basic needs are always covered regardless of market performance

- Longevity Protection: Guaranteed income streams typically last for life, eliminating the risk of outliving your essential income

- Happiness Factor: Research shows that retirees with guaranteed income sources report higher satisfaction levels

- Simplified Budgeting: Makes financial planning more straightforward when basic expenses are predictably covered

- Reduced Anxiety: Minimizes worry about market volatility affecting your ability to meet essential needs

Cons

- Inflation Concerns: Some guaranteed income sources may not adequately adjust for inflation; inflation-adjusted annuities or Social Security COLAs can address this to varying degrees

- Limited Growth Potential: Assets tied up in guaranteed income products may limit overall portfolio growth

- Reduced Flexibility: Less liquidity for early retirement "wants" or unexpected expenses

- Opportunity Cost: If you don't live a long life, the premium paid for guaranteed income might not have been worth it

- Legacy Limitations: May reduce the amount available to leave to heirs if significant assets are allocated to lifetime income products

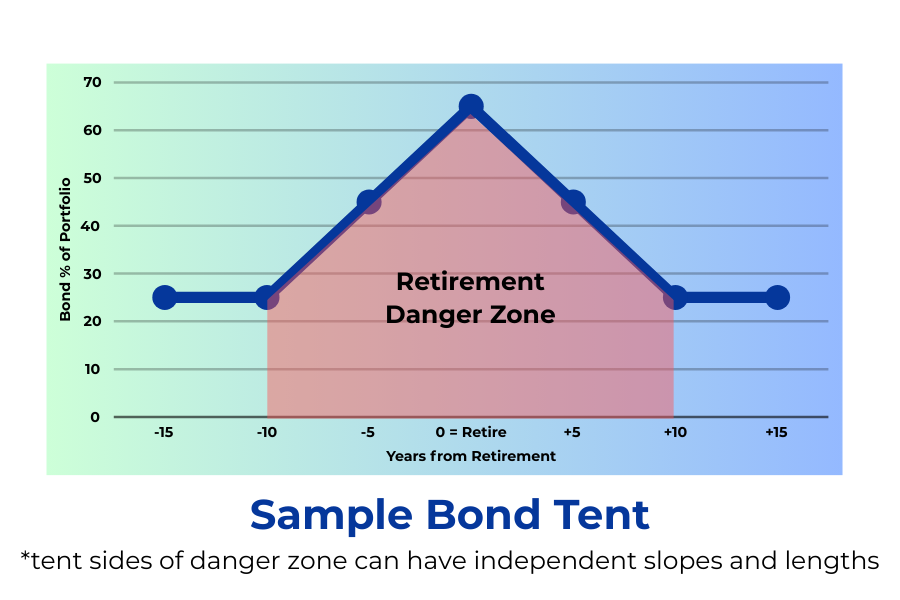

Bond Tent Approach

How It Works

Developed by financial planner Michael Kitces, this strategy involves increasing bond allocation as you approach retirement (building the tent), reaching maximum bond allocation at or shortly after retirement, then gradually decreasing bond exposure through retirement (lowering the tent). This "tent" structure is specifically designed to provide a buffer against negative market returns during the critical Retirement Danger Zone – the period spanning a few years before and after retirement when portfolio withdrawals are most sensitive to market downturns.

Pros

- Sequence Risk Protection: Specifically designed to protect against sequence of returns risk during the crucial years around retirement

- Strategic RMD Management: Can help optimize Required Minimum Distributions by drawing down bond assets in early retirement years

- Tax Efficiency: May create opportunities for tax-efficient withdrawals in early retirement

- Growth Preservation: Protects growth assets during vulnerable early retirement period while allowing for long-term equity exposure

- Research-Backed: Based on detailed analysis of historical retirement scenarios

Cons

- Active Management Required: Demands more attention to asset allocation and rebalancing

- Potential Opportunity Cost: Higher bond allocation could limit returns during bull markets

- Timing Complexity: Determining the optimal pace for building and lowering the "tent" can be challenging

- Interest Rate Sensitivity: Performance highly dependent on interest rate environment during the critical implementation phase; rising interest rates could negatively impact existing bond holdings within the “tent”

- Implementation Challenges: May be difficult to execute across multiple account types with different tax treatments

The Bottom Line

No single retirement income strategy works perfectly for everyone. Your optimal approach depends on your personal financial situation, risk tolerance, spending patterns, and even your emotional relationship with money. Many successful retirees actually blend elements from multiple strategies.

The Bond Tent approach offers a particularly compelling balance for those who are comfortable with stock market investing but want to mitigate the very real sequence of returns risk. By temporarily increasing bond allocation during the vulnerable transition years into retirement, it provides protection when your portfolio is at its largest and most vulnerable, then gradually shifts back toward growth investments for longevity protection.

Personally, I'm leaning toward implementing the Bond Tent approach given my comfort with investing developed over my adult life. However, I'm also considering a hybrid strategy that incorporates elements of the Safety-First approach later in retirement. Around age 80, I may purchase an annuity to create additional guaranteed income, which would safeguard against longevity risk while potentially increasing the likelihood of leaving a meaningful legacy to heirs. This combined approach addresses both the critical early retirement years and provides security in advanced age.

However, the best strategy is one you can stick with through market ups and downs. Consider your own temperament, spending needs, and priorities when choosing your approach. And remember, a good financial advisor should adapt to your preferred strategy rather than forcing you into their standard approach.

What's Your Plan?

Which retirement income strategy resonates most with you? Perhaps it's one we've covered here, a combination of approaches, or something entirely different. The important thing is that your strategy aligns with both your financial needs and your personal comfort level.

This blog post is intended for educational and informational purposes only. The views expressed are solely those of the author and do not represent professional financial advice. While every effort has been made to ensure the accuracy of the information presented, it should not be relied upon as a substitute for individualized advice from a qualified financial advisor. Financial decisions are complex and personal, and readers are strongly encouraged to conduct their own due diligence and seek professional guidance before making any investment or financial planning choices.

- Chris Maggio, Founder, Retirement Planning Partner, Kirkland, WA—providing fee-only retirement planning to clients in Seattle and across the US.